[Abstract] The best development strategy for Apple's Mac computer business in the future will still be closely following iOS, making full use of the latest developments in iOS to strengthen Mac products. At present, Apple has adopted this strategy and achieved good results.

Tencent Digital (Wen Xin) According to the AppleInsider website, it is more realistic to consider the future of Apple's Mac computer business. It is no coincidence that some models of Mac models have not been upgraded for many months, but it is also true that Apple faces practical constraints in substantially increasing Mac sales. This article will discuss possible future development of the Mac.

The future of Mac consists mainly of two elements: macOS and Mac hardware as a software platform. Apple has been continuously upgrading macOS. More than 10 new versions have been released in the past 16 years, which is almost twice as much as Windows in the same period. Apple's latest version of the desktop operating system, macOS 10.12 Sierra, supports Mac hardware since 2010.

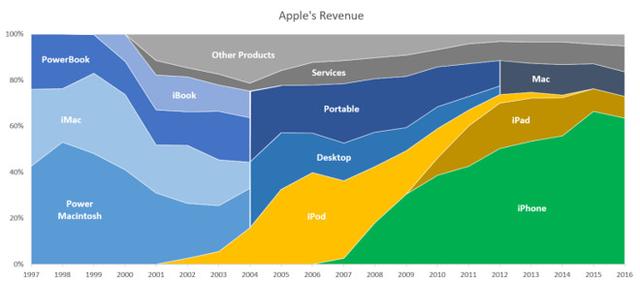

For many Mac users and potential Mac users with specific needs, what is even more troublesome is that some Mac hardware has not been upgraded for many years, leaving the outside world wondering whether Apple still attaches importance to some niche companies that were once considered strategically important—including professional The audio, video, graphics and publishing companies, especially in the iOS - Apple's post-PC era of large-scale popular platform. The iOS platform has become Apple’s main revenue and profit source.

Slow Mac upgrade

On Apple’s current "Compare Mac Models" page, there are more than 10 Mac products, of which 7 are laptops and 3 are iMacs. The other two have not been substantially upgraded over the years: Mac mini And Mac Pro.

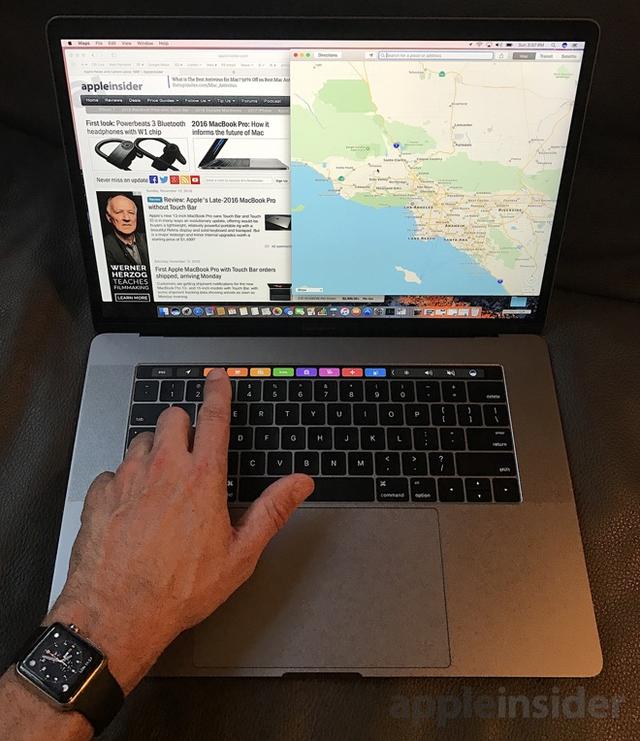

The 2016 MacBook Pro, which was released in October last year, was also considered a “late upgrade.†Prior to this, Apple’s best-selling high-end notebooks had not been upgraded for more than a year.

However, the upgrade of the 2016 MacBook Pro is not only reflected in the speed improvement, it involves a new generation of system architecture, including lighter, thinner body, wide color gamut display, and excellent audio, PCIe solid state Hard disk and Thunderbolt 3 interface.

Apple still sells the previous generation of MacBook Pro, but cut prices. In addition to MacBook Pro, Apple is still selling the 2016 MacBook (configured retina display) and the 2015 MacBook Air.

Apple has stopped selling the previous iBook or plastic body of the MacBook, as well as the 17-inch version of the MacBook Pro. At the lowest-priced notebook, the 13-inch MacBook Air, which costs $999 (approximately RMB 6889), Apple has an iPad Pro and an iPad.

Apple sells three desktops - the 2015 iMac, the 2014 Mac mini, and the 2013 Mac Pro. Apple no longer sells any version of Xserve, as well as Mac Pro Server or Mac mini Server.

This will lead to the user's doubts, why does not Apple accelerate the upgrading of existing products? Why did Apple stop selling high-end workstations and servers? In addition, why does Apple not use the Mac brand for home servers, media and television computers, onboard computers, and combo devices?

With a little understanding of the company’s performance in selling the above products, users understand the answers to these questions.

Mac upgrade cycle is not accidental

Why did Apple not upgrade existing products faster? This article will answer this question with Apple's two upgrades to notebooks in 2016. These two upgrades are major upgrades to previous generation products.

With Intel and its Ultrabook project, PC makers have been "plagiarizing" the MacBook Air. Instead of simply reinstalling the retina display for the MacBook Air, Apple developed a new ultra-lightweight notebook, and then launched a new MacBook Pro product that integrates some of the same elements and has more processing power. Both new products use design techniques developed for the iPad.

The result of the release of the new product was a surge in Mac sales. If not to slow down the pace of upgrading, Mac sales can have such a fire? If Apple continues to make small upgrades, will Mac always feel "fresh"?

Most PC manufacturers frequently upgrade their products, constantly changing PC components, and providing the latest or cheapest models. The result is non-periodic sales. Another result is the clearance model associated with the continuous clearance of inventory, which will cause potential buyers to wait for the low price to purchase the clearance model instead of the newly released new product.

On the eve of the release of the new Mac, Apple will also clean up inventory, but it usually accomplishes this task through partners. Partners will sell Apple's older models at a low price, but sales are small because Apple usually releases new products when existing stocks are about to be sold. This will make potential buyers pay attention to new products, rather than deal with the old model products.

Making the new MacBook/Pro and the older models sold at a discounted price have a clear "generation gap" that offers more options in terms of price, but it does not make potential buyers face too many products that have little or no differentiation.

This is the classic Apple way, which is also evident in the iPhone and iPad sales. Apple’s competitor in the mobile phone and PC fields usually sells several product lines with mutually-intersecting features and prices, instead of just selling a new product and products of the previous year, which not only causes confusion to consumers, but also to manufacturers and For retailers, this is also a huge challenge, because they must create accounts for hundreds, not just a few products. The result is an overstocked inventory, a product with greater discounts and support for more difficult products.

Only when major new technologies emerge (such as the new design of the Mac notebook last year and Touch Bar touch bar functionality) did the product be upgraded, and Apple could sell new products to "hungry" customers who had been expecting product upgrades. By dividing the cycle, Apple can better manage its inventory levels. Although Apple's inventory management is still very complicated, it has been much simplified compared to upgrading more products every quarter.

A longer product cycle creates expectations, allowing buyers to feel comfortable buying high-end products because they know that the products they buy will not be replaced by newer products released in subsequent months. The same trend appears in the automotive and apparel industries, the more high-end products, the more obvious the periodicity.

In addition, a longer product cycle allows Apple to release products with major new features - the cost of development is also very high, and then use new features as the main selling point, quickly sell large quantities of new products at high prices, to recover investment and profit. Frequently updated products, popular hardware vendors rarely launch important new technologies because they are unable to develop such new technologies.

The point often made by Apple executives at a financial analysts' conference call is that the cost of parts and components is higher at the start of new product releases, and therefore the profit margin is even lower. Over time, the reduction in the cost of parts and components will lead to a higher profit margin in the remaining period of the product cycle. If the product cycle is significantly shortened, the ability to use the cost of components to reduce profits will also be weakened.

It can be said that if Apple does not extend the cycle of introducing new technologies, it may not be able to introduce new technologies.

Multiple overlapping product cycles

Another advantage of the manufacturing cycle is that Apple can push the Mac in one cycle and then push the iPad Pro in different seasons rather than always pushing the two products at the same time. Last winter, Apple put its focus on Mac notebooks. Apple is currently promoting the iPad Pro, calling it a "better than computer" computing device. This will be the launch of the new iPad in March this year.

Apple first looked for buyers who needed Mac Pro laptops, but now they are turning their attention to users who sell for less than $1,000 (about RMB 6895) and the easier-to-use iPad can meet their needs. If both products are promoted at the same time, they seem to be in conflict. By changing its focus at different times, Apple can better meet the needs of different user groups.

Although critics often criticize the periodicity of Apple's product sales, or use it to obtain misleading statistics, the purpose is to prove that Apple's product sales have fallen from the peak of the product cycle. The reality is that Apple is able to use its product sales cycle in a sophisticated manner and outperform any other company in selling technology products. But Apple was not like this at the beginning.

In the 1990s, Apple also updated Macs as frequently as other PC makers, trying to sell a large number of Performa desktops in different configurations, mid-range Centra Mac, and high-end Quadra. Faced with such a large variety of product models, buyers will be confused and product inventory management will be confusing. Steve Jobs drastically simplified the product line.

Over the past few years, Apple has been working on major Mac upgrades that can drive product sales. For models that cannot drive sales, they will follow Xserve's lead. This is not to say that Apple will not make mistakes, but it is better at summing up experience and learning lessons.

Mac Pro

AppleInsider stated that the Mac Pro released in late 2013 may be a mistake. The conditions for its design upgrade are not yet available, and the sales volume cannot prove the reasonableness of a regular substantial upgrade. If the product cycle is too long, the benefits of properly extending the product cycle outlined above will no longer exist. For Apple, a better way is to design systems that other vendors can upgrade -- to install standard PCIe graphics cards, and even upgrade processors.

One possible situation is that Apple has problems with the integration of design skills for iMacs and iPhones into the field of workstation-class PC products. This approach did not succeed in designing the Xserve. It did not meet the basic requirements that rack-mounted server buyers considered important, but rather focused on features that the market did not care about (including ease of use, simple user interface).

Apple can also rethink its Mac Pro strategy in some potential directions. The simplest change will be to open up its existing designs so that third parties can upgrade processors and graphics cards. One way to upgrade processors and graphics cards is through the Thunderbolt 3 interface.

By enabling third-party components to connect to the system with Thunderbolt 3, Apple can meet the needs of high-end MacBook Pro and Mac Pro users. The reason why Apple didn't adopt this strategy before was very simple: Thunderbolt 3 has just begun to be applied. Simply upgrading Thunderbolt 3 for Mac Pro will bring great benefits to professional Mac users.

However, the development of an upgraded Mac Pro cannot change the fact that the demand for Mac desktops is currently limited. Part of the reason lies in Apple's restrictive macOS platform strategy - fully focused on Apple's own production of Mac hardware.

External license macOS?

One way to expand the audience of Mac Pro may be to license Apple's core architecture design to third-party vendors, which can enhance the value of macOS hardware and expand hardware requirements. Apple may also work with other PC vendors to use it to design and develop workstations and high-end desktops running macOS.

Apple's recent attempt to license the Mac began in 1994, providing third-party hardware vendors with computer specifications for running the Mac OS. Facts have proved that licensing Mac OS to foreign companies is not worthwhile for Apple because Apple needs to do a lot of R&D work with no return for this, and only the loss of sales of high-end Mac computers will come back. At the time, high-end Macs contributed most of their profits to Apple.

At the time, the Mac was not a standard PC but a dedicated computer system that required a Mac operating system. Since switching to Intel chips in 2006, Mac has essentially become a subset of the standard PC architecture. At present, most of Apple's profits no longer come from high-end Mac desktops, leaving the market to partners with a much smaller impact.

Apple can sell motherboards developed for Mac Pro to third-party PC makers, or develop standard motherboards that partners can use in high-end desktops, workstations, and even servers, rather than simply authorizing them to run the Mac operating system on their own hardware. Apple itself has lost interest in these markets.

Apple already has an MFi licensing program related to the iOS product line, expanding MFi scope to high-end macOS devices, allowing third parties to take risks in expanding these markets.

Apple adopted a similar strategy in the Internet of Things market and released HomeKit. Apple did not develop its own smart home hardware, but developed specifications to allow third-party devices to access its platform.

By limiting the terms of the licensing deal, Apple can continue to build its overall macOS platform strategy - while limiting the scope of its technology's potential applications, it limits the types of products it needs to support the task.

One possible drawback is that such permission projects may interfere with Apple. However, a bigger problem is that in high-end markets such as CAD (computer-aided design), biotechnology, and other STEM (science, technology, engineering, and mathematics), Mac needs may not be large enough.

Challenge Windows

To expand its market for Mac Pro hardware (or Mac Pro license partner hardware), Apple can develop more software for macOS through more aggressive strategic acquisitions. Apple successfully acquired Final Cut Pro and Logic Pro before, and opened up the PowerMac hardware market nearly 20 years ago.

Although Apple is currently committed to using the iPad Pro to erode the entry-level Windows PC market, Apple can develop a series of high-end PC software and make them run only on macOS. By launching a full-scale attack on Windows, Microsoft is caught off guard. In the era of professional use of Unix decades ago, Microsoft took a similar strategy for Unix vendors when it opened up the market for Windows NT.

Ten years ago, Windows still occupies an unshakable monopoly on the PC market. At present, Microsoft is working hard to open up the hardware and cloud services market. Through the development of professional software and the acquisition of strategic software developers, Apple can attack Windows from two directions: iPad as a weapon at the low end, and Mac Pro and macOS compatible hardware as weapons at the high end.

Apple only needs to make a big move in several high-margin Windows PC market segments, which will cause serious problems for Microsoft's other Windows license business. This will leave Microsoft with the lowest-value PC segment, greatly increasing the size and value of the macOS platform. Microsoft will become weaker than ever before, and Apple will become more powerful than ever.

Following Microsoft's "Bill Gates" strategy to occupy multiple markets: white-collar workers, high-end graphics professionals and video game players, Apple may defeat Microsoft. Because of the excessive investment in unreliable businesses (such as console games, annual revenues of less than 5 billion U.S. dollars (about 34.5 billion U.S. dollars)), the much higher value of business (which brings more than 150 billion U.S. dollars to Apple every year) The mobile phone and tablet PCs in the field of revenue (approximately RMB 1.0344 trillion) have lost ground. Microsoft will lose its strength in the PC market.

PC market value geometry?

When considering the potential of Apple to erode the Windows market and expand the Mac business, it must also consider the size of the PC desktop market. Although Apple may take some measures to stimulate traditional computer demand, the reality is that the potential demand is limited and the market potential seems to have been exhausted.

Apple did not sell Mac computers by product line or by desktop and laptop computers (Apple disclosed relevant data before 2013), but we can use the industry data to estimate Apple’s annual Mac desktop sales. The shocking thing is that Mac desktops do not sell very well every year.

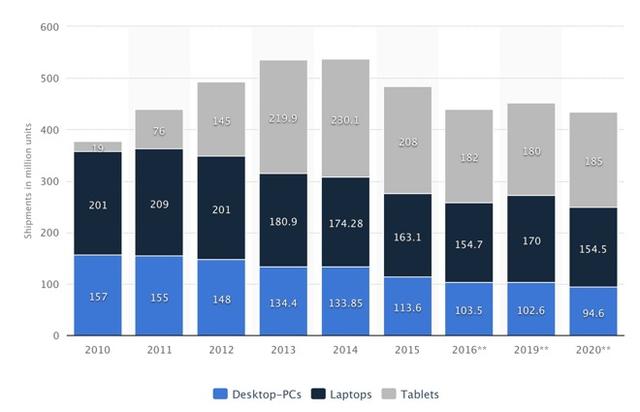

Market research company TrendForce's data shows that in 2016 sales of 159 million units of the "notebook market", HP's market share was 20.7%, followed by Lenovo (20%), Dell (14%), ASUS (10.7%) And Apple (10.3%). It should be noted that the "notebook market" here includes Dell's Chromebook netbook, but does not include the Apple iOS iPad or iPad Pro.

This figure is close to the 2016 PC sales figures estimated by market research firm Statistica - 154.7 million notebooks, 103.5 million desktops, and 182 million tablet PCs. It is worth noting that Statistica estimates that there will be little change in total sales of all types of products by 2020.

Market research company IDC published a research report that the combined sales of desktops and notebooks in 2016 was 260 million units, which is slightly different from that of TrendForce and Statistica, but it is quite similar.

Subtracting TrendForce’s notebook sales from IDC’s total PC sales indicates that Lenovo, Hewlett-Packard and Dell sell the vast majority of desktops (each company sells between 18.4 and 27.7 million units), with desktops on their PCs overall. The sales accounted for about 39%-45%.

In sharp contrast, Asus and Apple sell only about 2 million desktops per year, which is equivalent to 11% of their total PC sales. Therefore, of Apple’s total sales of about 5 million Macs per quarter, only about 500,000 are desktops—most of them are iMacs, and Mac Pro and Mac mini sales are very low.

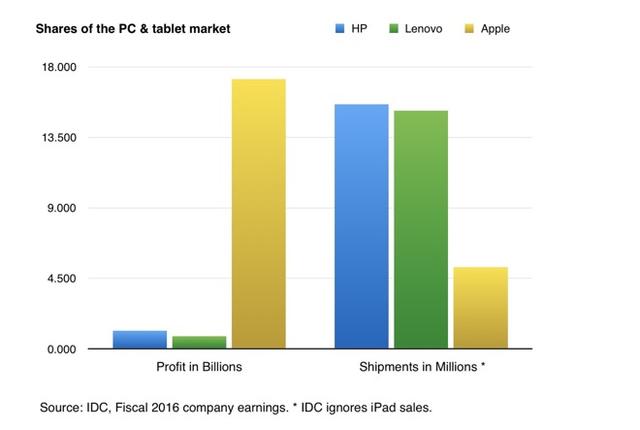

On a revenue basis, HP’s personal system (non-printing business) revenue for 2016 was US$29,987 million (approximately RMB 206.8 billion), of which laptops were US$16.98 billion (approximately RMB117.1 billion), and desktops were 99.56. Billion U.S. dollars (about 68.7 billion yuan), workstations were worth 1.87 billion U.S. dollars (about 12.9 billion yuan), and other products were 1.18 billion U.S. dollars (about 8.1 billion yuan). As a result, notebooks accounted for approximately 61% of HP's PC sales and approximately 56.6% of its revenue. In FY 2016, HP’s personal system profit was only US$1.15 billion (approximately RMB 7.9 billion).

In fiscal 2016, Lenovo’s “PC and Intelligent Device Group†revenue was US$29.6 billion (approximately RMB204.1 billion). At present, Lenovo's quarterly profit is less than 200 million U.S. dollars (approximately 1.38 billion U.S. dollars), and the loss in the previous fiscal year exceeded 200 million U.S. dollars.

Dell has now withdrawn from the market and does not need to publicly disclose its results. However, like HP and Lenovo, Dell's desktop sales still exceed Apple's, although profits are not high. Therefore, this is not an attractive market. The traditional PC market is not always gold, and it lacks sufficient appeal to Apple.

However, Apple apparently used the iPad Pro to erode the low-end notebook market. This strategy was successful because Apple could provide a high-end iPad experience at a price similar to that of the slower, heavier, and more complicated Windows notebooks.

In the fiscal year of 2016, Apple’s Mac business revenue was US$22.83 billion (approximately RMB157.4 billion), and iPad revenue was US$20.63 billion (approximately RMB142.3 billion). Both sales were 18.5 million and 45.6 million.

Apple's Mac business revenue is equivalent to 76% of HP or Lenovo's, according to IDC data, HP or Lenovo's sales "market share" three times that of Apple.

However, this comparison is slightly unfair, because HP and Lenovo's revenue data include tablet PCs and other products. iPad and Apple's non-mobile computing equipment business revenue of 43.46 billion US dollars (about 299.7 billion yuan), is more than 145% of HP or Lenovo's similar business, or 73% of the sum of the two companies.

Although notebook sales are about twice as much as Apple's and desktop sales are about 10 times as much, HP and Lenovo's revenue is only about 69% of Apple's, and their profitability is much lower than that of Apple. So the question is: Can Apple nibble at their desktop and workstation businesses and get more revenue from their existing customers or new Mac computer buyers?

Acquisition, cooperation or competition?

Apple can spend about 50 billion U.S. dollars (approximately RMB 344.8 billion) to completely acquire HP (only purchase PC business prices will be lower). Even if calculated according to the fuzzy IDC standard, this transaction can make Apple become the leading market share PC company, but this will also cause Apple's PC business profit margin to decline.

Even if Apple can actually acquire a PC vendor with a different business model and reshape its product according to its own brand image (Google’s acquisition of Motorola would not be able to achieve this goal), no one can guarantee that most HP customers will migrate to the HP brand. Mac, not buying Dell or Lenovo's Windows PC.

However, if Apple can collaborate with Hewlett-Packard (or Dell) to provide macOS PCs for the high-end Mac Pro market, Apple can use these PC vendors' core competencies to support corporate customers and enter markets that they cannot access. This may expand the macOS user base and it is worth the effort of Apple.

This also requires the strategy discussed above for the development of exclusive Mac Pro applications for the macOS platform to ensure that macOS PCs have sufficient market demand and attract partners willing to produce macOS PCs.

The third option is what Apple seems to be doing: Upgrade the best-selling Mac to maximize PC users' use of Mac hardware. This strategy works well (although at a slower pace) but is not suitable for users whose current Mac hardware does not meet their specific hardware needs.

opportunity cost

In order to occupy the rest of the non-high-end PC market, the war on Windows and the efforts to create exclusive macOS software are costly. Another way to invest is to invest in computing devices that are large in sales and more profitable than PCs: mobile devices.

This is why Apple has beaten Microsoft and Google (HP, Lenovo, Dell, Asus and Samsung) by focusing on selling high-end mobile devices. The iPhone is a higher-margin computing device and the swap cycle is much shorter than the PC. The PC swap cycle is usually 5 years or longer.

This is why Apple is mainly investing in the iOS App Store instead of the Mac App Store. Nearly one billion users download and purchase applications from the iOS App Store. The potential user base of the Mac App Store is only nearly 150 million.

Recently, Apple has the potential to sell tens of millions of iOS devices to the newly emerging middle class in China, India and other regions. The potential for selling high-priced PCs, especially high-end models, is much smaller.

In addition, new forms of computing devices (wearable devices), product types (such as TV set-top boxes), and device applications (portable cash registers, retail display tools) originate from mobile devices rather than traditional desktops.

The technology used in the next generation of products will be smaller, more efficient chips, sensors, displays, and designs, rather than improvements to Mac desktops or PC desktops.

To strive for the upper reaches and remain not eliminated, Apple should focus on future computing technologies rather than future Mac computers.

PC has vitality

AppleInsider said, of course, Mac desktop still has market demand. The demand for processing power of PC users will continue to grow, which means that the processing power of the processor needs to be continuously improved, and the connection needs to continue to improve. macOS needs to continue to update and improve security.

Apple Mac business is bigger than ever. Even if the Mac market does not grow significantly, maintaining only the current user base is a good business. However, this does not prove the value of expanding the Apple Mac desktop business on a large scale through investments.

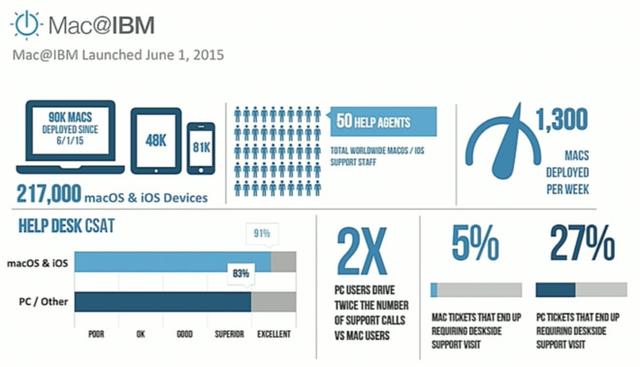

The best opportunity for Apple may be to use iOS: Use IBM's MobileFirst Swift/iOS consulting service to promote Macs among businesses and developers. Customers tend to use Macs after adopting iOS devices. Apple is constantly improving its Mac products. Satisfaction will increase when iOS users switch from traditional PCs to MacBooks or iPad Pros.

IBM said that the use of Mac to switch to Windows PCs within the company has been a success. Since 2015, nearly 100,000 Macs and 130,000 iOS devices have been deployed. Each Mac can enable IBM to save 270 US dollars (about 1862 yuan) support costs.

It is worth pointing out that Apple sees itself as a creative force to change the world, especially in the era of Jobs. Apple’s current chief executive, Tim Cook, may consider more to maintain his current business than to seek revolutionary new technologies, but even Cooke made it clear that in order to attract the best talent, Apple cannot Just satisfied with being a PC manufacturer.

There may be new technologies that can greatly enhance the Mac desktop experience - such as 3D sensors that support virtual reality Facetime, or new gaming experiences. But market enthusiasm has turned to mobile devices.

In the field of mobile devices, Apple can promote the development of the industry, change the interactive mode, introduce new camera technologies and introduce new application ideas that can change the world. In the desktop and notebook areas, this type of change is much less likely. Apple mainly follows the PC industry, using Intel processors, AMD and Nvidia graphics cards, memory standards and other components.

The most exciting new elements Apple brings to desktop computing are mainly from iOS. Recent examples include Siri Voice Assistant, Touch ID Fingerprint Sensor, Apple Pay Mobile Payment, Messaging, and Touch Bar. For example, use an iOS device processor for your Mac to extend battery life.

Why does Apple not use the Mac brand for home servers, media and television computers, automotive computers, and two-in-one variants? The answer is simple: These products will not be successful, it is a waste of money, Microsoft's efforts over the past 20 years have proved this.

Factors that can bring about significant changes

Of course, in addition to historical trends and current market realities, there are other potential factors that can change the future of traditional desktops. Apple can develop new technologies - in terms of software and chips, to increase the attractiveness of Mac compared with Windows PC.

One potential factor is the exclusive ability to run critical software on the Mac. This involves attracting popular applications on the Windows platform, or Apple alone or in cooperation with IBM, Deloitte and other companies to develop new exclusive Mac software.

Another way that Apple can significantly increase the value of the Mac is to enable users to run existing iOS applications on the Mac desktop. This will ease the burden of developers porting iOS applications to macOS, allowing companies to develop custom applications on iOS as a standard platform, and enable users who need or like traditional PCs to run these applications on Mac hardware.

Another factor that will increase the price competitiveness of the future Mac will be the introduction of an ARM-based chip-based Mac. This allows the MacBook to cut processor and graphics costs, increase memory and storage device capacity, and increase their appeal as PC replacements - prices as low as nearly $800 (approximately RMB 5,517).

Continuity features continue to be strengthened, but also help make Mac closer to the iOS ecosystem, increasing the difficulty of PC users with iPhones staying in the Windows camp. The tight integration with new devices such as Apple Watch and AirPods also makes the Mac an attractive product for PC users.

Innovative Mac features such as Touch Bar and Touch ID help strengthen the differences between the Mac and the basic Windows PC, making it easier and faster to complete part of the task.

It is worth pointing out that all these innovations that improve the competitiveness of Mac are derived from iOS. Apple's investment in mobile devices has spread to the Mac, including software, hardware, cloud services and integration. This means that Apple's best strategy to strengthen the Mac is to make Mac continue to follow iOS and improve collaboratively.

In the past 10 years, this strategy has increased the revenue of Apple from US$19 billion (approximately RMB131 billion) to US$215 billion (approximately RMB148.2 billion) and operating profit from US$2 billion (approximately RMB13.8 billion). ) It has grown to US$46 billion (approximately RMB317.2 billion). This means that Apple has the financial resources to invest in other projects.

Apple has plenty of money to improve the Mac Pro desktop - even if sales are small, it did so in 2013. However, this image project cannot be lasting.

Source: AppleInsider

Watch & Apple Airtag Screen Protector

TPU Watch Screen Protector, Transparent ​Watch Screen Protector, Watch Screen Protector Case, Apple Watch Case, Apple Watch Case Protector, Apple Watch Protective Case

Shenzhen Jianjiantong Technology Co., Ltd. , https://www.jjthydrogelprotector.com